In this article, we take a look at the most critical updates from the world of cryptocurrencies over the past week. Topics include Bitcoin, Donald Trump‘s inauguration, XRP, and much more!

TrumpCoin ($TRUMP) Smashes Records

Donald Trump launched his official memecoin, $TRUMP, just days before his second inauguration. Built on the Solana blockchain with a capped supply of 1 billion tokens, the coin saw an explosive 4,200% surge within hours of launch, reaching a market cap of $8 billion. Promoted as a symbol of strength and victory, $TRUMP quickly became the hottest topic in crypto, blending politics with digital assets like never before. Whether it will sustain its momentum or fade as a fad remains to be seen.

US Department of Justice States $9 Billion in Bitcoin Stolen in the 2016 Hack Should Be Returned to Bitfinex

In 2016, the infamous Bitfinex exchange hack resulted in the loss of approximately 120,000 BTC. This week, the US Department of Justice announced that all recovered BTC from this hack should be returned to Bitfinex. Out of the 120,000 BTC, 94,643 BTC have been recovered, with plans to return them. At current market prices, this represents over $9.5 billion in value.

Bitfinex publicly stated in 2019 that 80% of the returned BTC would be sold and used to repurchase and burn LEO tokens over 1.5 years. This could exert selling pressure equivalent to 75,000 BTC on the market. However, the exact timeline for BTC’s return remains uncertain and is a key development to monitor.

Trump Plans to Designate Cryptocurrencies as a National Priority

Donald Trump is expected to sign an executive order designating cryptocurrencies as a national priority as soon as Monday, January 20, 2025, upon his return to office.

According to Bloomberg, the order will direct regulatory agencies to collaborate with the cryptocurrency industry and could establish a crypto council to advocate for policies favorable to the sector.

The New York Times reported on January 16 that several crypto industry leaders provided feedback to Trump’s crypto advisor, David Sacks, on the executive order, which spans various areas of crypto policy.

The Washington Post noted this week that Trump is likely to sign an order on Inauguration Day addressing the de-banking of cryptocurrencies and repealing banking regulations requiring crypto assets to be reported as liabilities.

Reuters revealed that the SEC under Trump’s leadership is expected to freeze or revise some existing crypto measures as early as next week.

Economic Snapshot: Treasury Yields Fall as Inflation Concerns Ease

US Treasury yields fell significantly on Wednesday. The 10-year yield dropped by 13 basis points, while the 2-year yield fell by 10 basis points. This followed the release of December inflation data in the US.

While inflation rose in December, the year ended with encouraging economic signals, particularly in housing. Core CPI inflation for the year was lower than expected (3.2% versus the forecasted 3.3%).

Federal Reserve member Christopher Waller stated that a reduction in interest rates might be possible in the coming months as December’s CPI data suggests the PCE index is nearing the Fed’s target for the sixth time in eight months.

Crypto Market Recap: A Wild Week Begins

Last week emphasized the importance of the $3 trillion level for the total cryptocurrency market cap.

On Monday, the market hit bottom at this level, testing the 2021 cycle peak during a sharp sell-off. Bitcoin briefly traded below $90,000, while Ethereum dipped under $3,000.

This sell-off was likely triggered by panic in the US stock market over the weekend, exacerbated by low liquidity and intensified during the futures market opening on Sunday. The crypto market mirrored stock market movements, experiencing significant drops before finding a bottom and beginning to recover.

Better-than-expected mid-week inflation data provided much-needed positive momentum for both stocks and cryptocurrencies. The S&P 500 rose over 2.5% during the week, while Bitcoin is trading just above $104,000 at the time of writing.

Chart of the Week: XRP Hits New All-Time High

For the first time in 2,569 days, XRP broke its previous all-time high, trading above $3.40 yesterday.

This milestone means every XRP buyer over the last seven years is now either at break-even or in profit.

What’s Happening On-Chain? The Rise of DeFAI

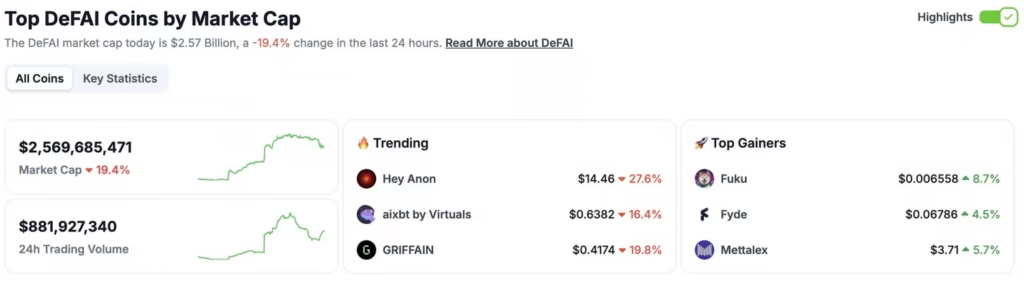

The latest trend in the cryptocurrency space is DeFAI, a combination of DeFi and AI. It merges two of the biggest current trends into a potential supertrend. DeFAI leverages AI to simplify and automate DeFi operations. AI agents enable asset trading, streamline token creation, and optimize yield management strategies.

Currently, leading projects in the DeFAI space include Griffain, Hey Anon, and Orbit. Griffain leads with a market capitalization of approximately $500 million, followed by Hey Anon at $250 million, and Orbit at $100 million.

In other news, the Solana-based DeFi exchange Jupiter has launched a reward eligibility check ahead of the January 2025 Jupuary airdrop, estimated at approximately $575 million. DEX users can now verify their eligibility for a share of the airdrop.

Meanwhile, the highly anticipated Abstract Layer 2 network, set to launch this month, announced its Abstract Incentives program. This program, rolling out on the mainnet, will likely allow users to earn XP through on-chain activities. On the Abstract mainnet, users and creators utilizing Abstract applications and streaming via the Abstract Global Wallet will gain XP. Additionally, developers will be rewarded based on the success of their applications.

Weekly Flows in Digital Asset ETFs: Modest Inflows Last Week, Recovery This Week

Last week, digital asset investment products saw modest inflows of $48 million. Ethereum recorded net outflows of $256 million, while XRP had net inflows of $41 million. Bitcoin ETFs led the way with net inflows of $214 million.

Interestingly, the first half of the week saw inflows nearing $1 billion. However, after the release of new macroeconomic data and FOMC meeting minutes signaling the Federal Reserve’s hawkish stance, the second half of the week witnessed outflows totaling $940 million.

This week, the trend reversed: significant outflows occurred early in the week, on Monday and Tuesday, followed by recovery with net inflows on Wednesday and Thursday. Spot Bitcoin ETFs have recorded net inflows of $888 million so far this week, while Ethereum spot ETFs have brought in $187 million.

Market Sentiment: Crypto in Extreme Greed, AAII Members Pessimistic About Stocks

The Fear & Greed Index for cryptocurrencies currently stands at 77, indicating extreme greed. In contrast, the stock market index remains in the fear zone at 29. This striking difference between the two markets is likely due to Donald Trump’s positive stance on cryptocurrencies and market expectations of favorable changes next week.

A survey of investor sentiment by AAII shows that its members are predominantly pessimistic.

In total, 40% expressed negative expectations for the stock market over the next six months, while only 25% expressed optimism. The last time optimism among members was this low was in early November 2023, when the S&P 500 began recovering from a correction of over 10% that lasted four months.

What Does Trump’s Inauguration Mean for the Markets?

The big question remains whether Donald Trump will deliver on his promises to make cryptocurrencies a top priority. Market participants will closely watch Inauguration Day for updates related to the crypto space.

The past few weeks have been turbulent, making future developments harder to predict. However, three scenarios seem possible:

- Buy the rumors: The inauguration could be a positive event if market participants doubt Trump will fulfill his promises, leaving room for positive surprises.

- Sell the news: The market is currently trading higher in anticipation of Monday’s big day. However, if Trump and his team fail to meet expectations, a downturn could follow.

- Neutral scenario: If Trump meets expectations exactly, with no surprises—positive or negative—the market may have already priced in his actions.

Market participants are likely to reduce risk positions ahead of Inauguration Day, potentially causing a slight dip in cryptocurrencies over the weekend. It is also important to note that US stock markets will be closed on Monday due to Martin Luther King Jr. Day.