The financial analysis industry is evolving fast. But new technologies are opening top opportunities even faster. Large language models like GPT-4 are very impressive in their superior performance regarding changes in corporate profitability compared to traditional financial analysts.

This article based on study will describe how LLMs can transform the way of handling financial data and research.

Fundamental Analysis – AI vs. Human

Financial analysis, also known as fundamental analysis, has traditionally been conducted by humans. Fundamentally, they try to answer whether the company has sustainable performance and understand its financial health.

The most prominent techniques and tools that could be applied by analysts are financial statement analyses, trend analyses, and computation of the major financial ratios like liquidity and operational efficiency. These indicators will help analysts in forecasting the future profitability of a company.

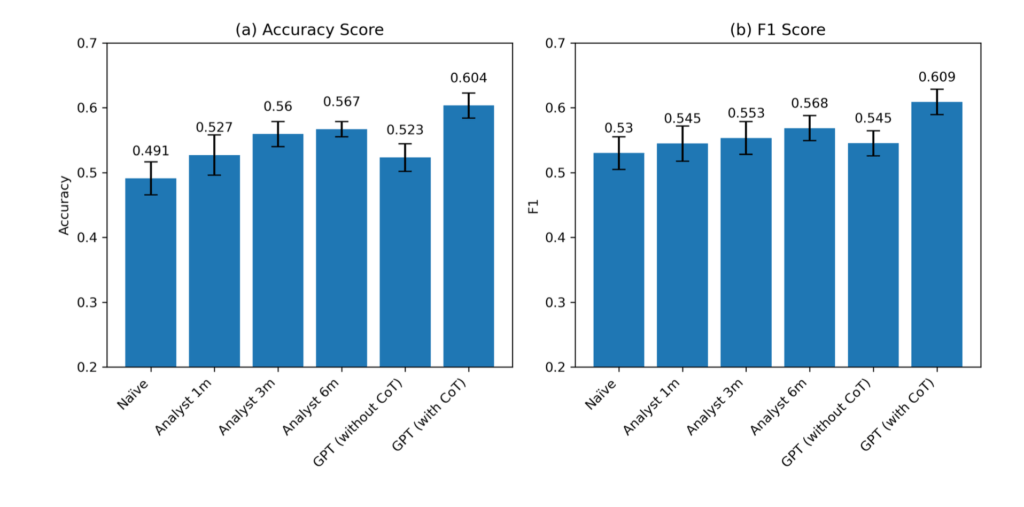

LLMs, and particularly GPT-4, quickly bridge the gap with human analysts to emerge as equally strong competitors. Actually, research has shown that it is quite possible for GPT-4 to analyze financial statements and make a prediction of a company’s future performance as well, or even better than, human analysts. This result is even more remarkable considering the fact that GPT-4 performs this level of analysis without any sort of access to narrative information, which generally brings along important context.

Pros of LLMs in Financial Statement Analysis

The main reasons for the high success rates of LLMs are due to the fact that they process vast amounts of unstructured data and perform great at tasks requiring knowledge on a wide array of subjects. For example, GPT-4 has already proven successful in answering questions related to financial theory and even in estimating macroeconomic indicators from just headlines.

Another important advantage associated with LLMs is the fact that they are capable of complementing a human analyst. An aspect that is mainly associated with increasing situations where analysts usually exhibit biases and imperfections when predicting. GPT-4 has been particularly able to prove useful in those cases where a human analyst has a higher tendency to generate errors.

The Future of Financial Analysis

The results of the studies foreshadow that LLMs similar to GPT-4 could play a major role in the future of financial analysis. Moreover, besides their ability to perform comparably to or even better than traditional analysts, they hold the potential for democratizing financial decision-making. Indeed, this progress will help small investors who may miss important signals generated by advanced AI tools.

Conclusion

While the technology of AI is on the rise, so is the human element and experience in relation to decision-making, particularly that requiring context and intuition. Of the more fascinating tools for modern analysts, LLMs could be an additive to the arsenal that could hugely enrich them in terms of deeper and faster analysis of financial data.

Info about study:

- Name: Financial Statement Analysis with Large Language Models

- Authors: Alex G. Kim, Maximilian Muhn, Valeri V. Nikolaev

- Date: May 20, 2024