Bitcoin’s Price Experiences High Volatility as Market Logic Fades

Bitcoin’s price has been experiencing considerable volatility lately, and market logic seems to be fading. At a time when the world’s largest economy is actively supporting cryptocurrencies—and when the U.S. president himself is making significant investments in crypto—a strong rally might be expected. Yet on Monday, Bitcoin tested levels around $91,000. Market sentiment is shifting rapidly. Is altcoin season approaching?

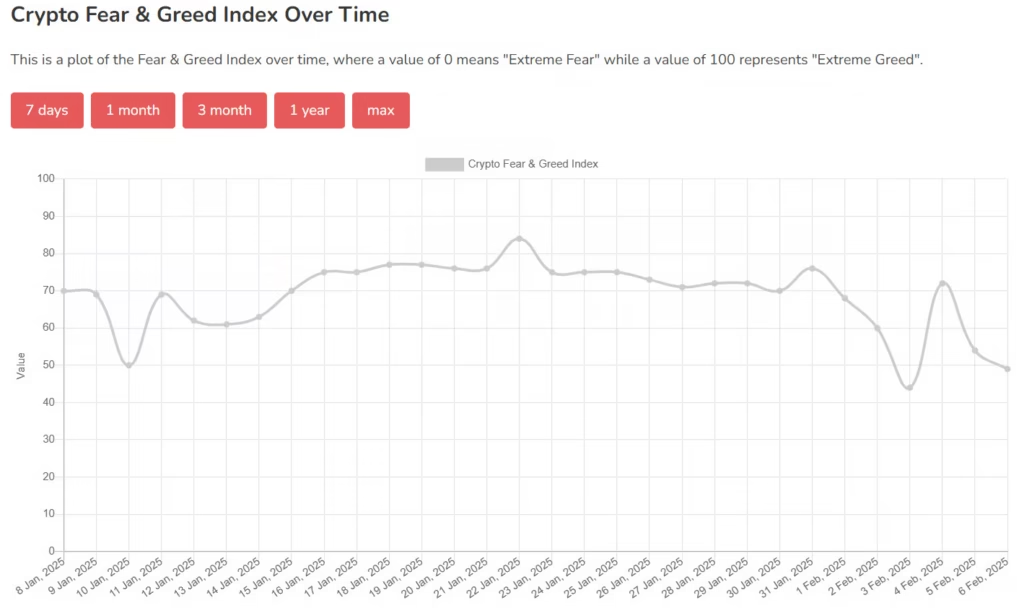

Fear and Greed Index Reflects Market Mood Swings

The Fear and Greed Index, which aims to measure current market sentiment around Bitcoin, has fluctuated significantly in recent days. On Friday, it showed a value of 76, indicating extreme greed. However, by Monday it had dropped to 44 (neutral sentiment, leaning toward fear). On Tuesday, it rebounded to 72 (greed, near extreme levels), and today it stands at 49 (neutral).

The index is composed of the following factors: volatility (25%), trading volumes (25%), social media sentiment (15%), dominance (10%), and Google Trends (10%). Previously, weekly surveys from Strawpoll.com (15%) were also included, but over time their relevance has diminished.

Traders Anticipated the Arrival of Altcoin Season

Toward the end of last year, there was frequent speculation about the beginning of altcoin season. Benjamin Cowen, the creator of the Into The Cryptoverse tool, predicted as early as August that once Bitcoin dominance reached 60%, there would be a shift toward altcoins. In early November, Bitcoin dominance did indeed start to decline, briefly dipping below 55%. However, since December, it has reversed course and begun to increase again—reaching 64.34% this week.

When Will Altcoin Season Begin?

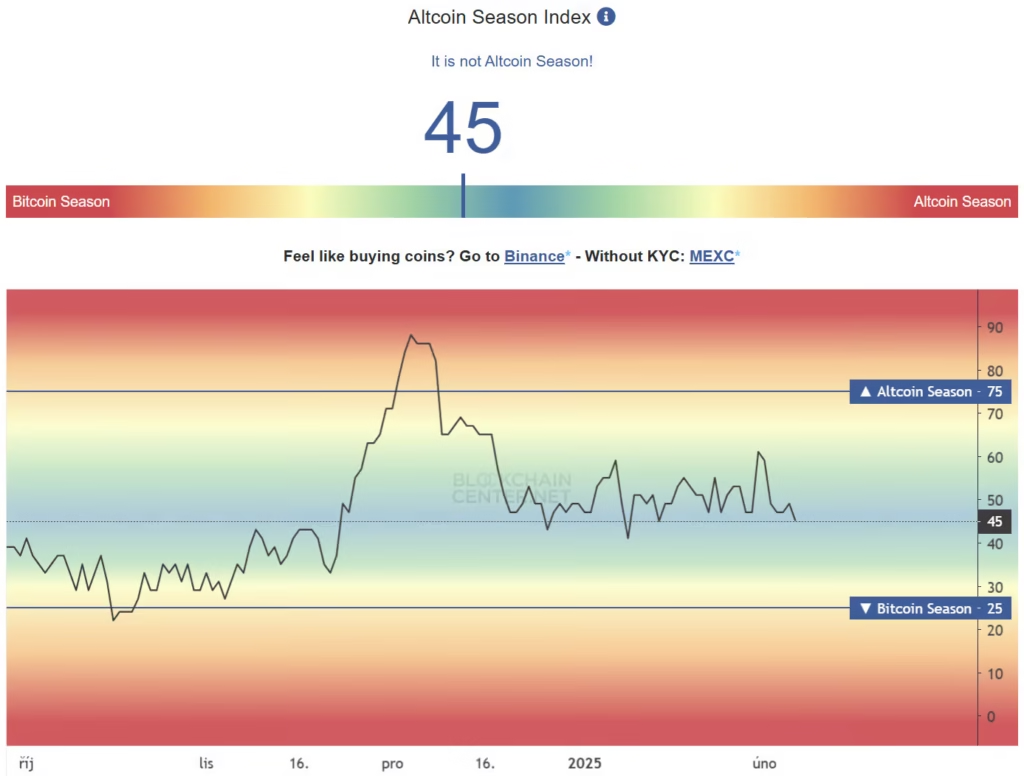

No one can say for certain when altcoin season will start, but some analysts believe that market behavior has changed. Based on historical trends, it appears that some investors have already started allocating funds directly into altcoins and meme coins, thereby altering established patterns. The Altcoin Season Index is perhaps the best indicator of this shift.

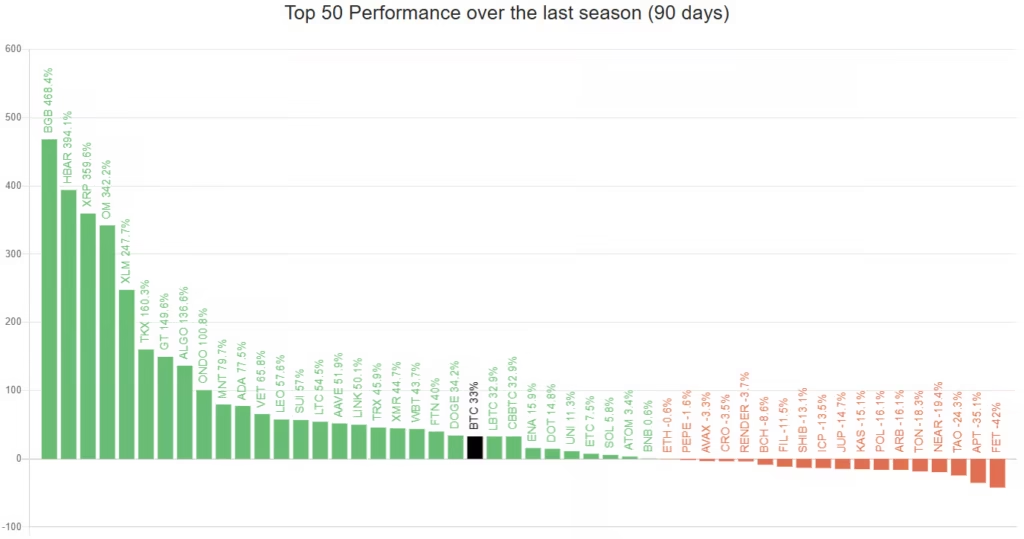

This index measures the performance of the top 50 altcoins over the past 90 days and compares it to Bitcoin’s performance. If Bitcoin performs better than 25% of these altcoins, it is considered to be in Bitcoin season. Conversely, if Bitcoin’s performance is worse than 75% of the altcoins, it is considered to be altcoin season.

The chart shows that in December, altcoins significantly outperformed Bitcoin for a brief period, but the market has since returned to equilibrium. Current results indicate that Bitcoin’s performance has remained mid-range within the index.

The Role of U.S. Events in Bitcoin’s Performance

I personally believe that Bitcoin’s strong performance is being driven by events in the United States. Spot Bitcoin ETFs are breaking records, the president is investing in crypto, and the government is preparing legislative changes to include Bitcoin in the strategic reserves. Without these events, I suspect that Bitcoin’s performance wouldn’t be as high and altcoin season might have already begun. I expect this hype to fade by spring, at which point we may finally shift into altcoin season.