Yesterday, the bitcoin price once again quickly tested the USD 90,000 level, dipping below it for a few minutes. It then rebounded, and we are currently back around USD 95,000. Interest remains strong, as confirmed by the decreasing number of bitcoins available both on and off exchanges. Supplies are shrinking, and we may be approaching a period when the market starts to feel a sense of scarcity.

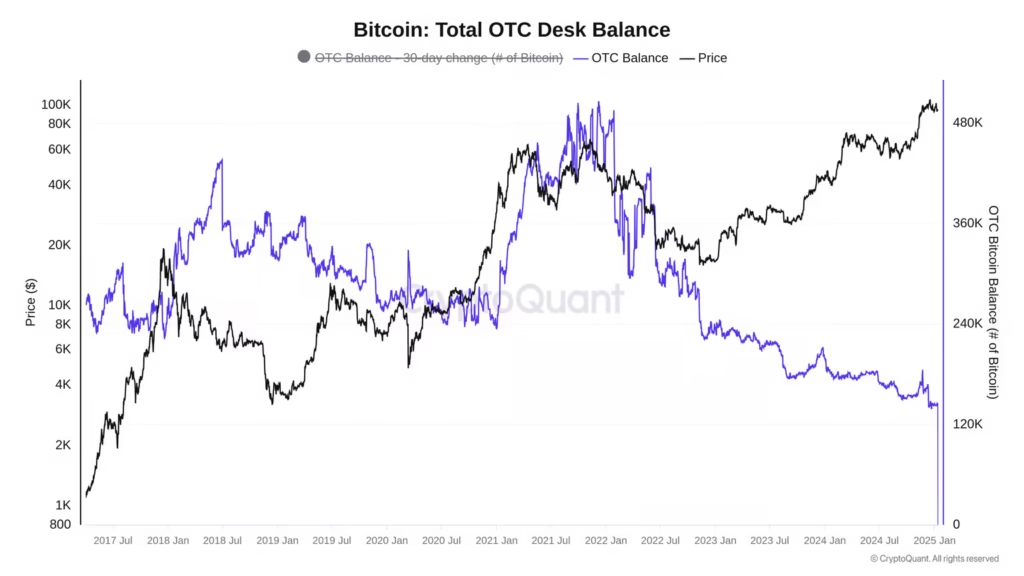

In my Sunday analysis, I pointed out the declining number of bitcoins available OTC (Over-the-Counter). This is primarily where spot Exchange-Traded Funds (ETFs) have been buying up coins, and their entry onto regular cryptocurrency exchanges is still anticipated. That moment is likely not far off, because in December alone, approximately 14,000 new coins were mined, while spot ETFs bought three times that amount.

Potential “Supply Shock” Could Send Prices Soaring

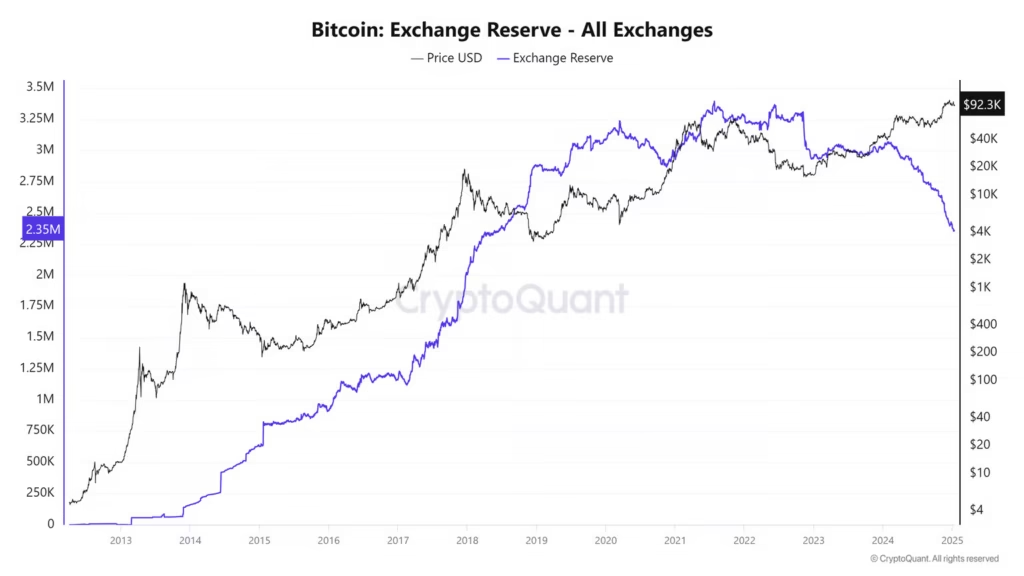

The declining supply is not limited to OTC. A look at cryptocurrency exchanges shows that their reserves are also thinning. Currently, there are about 2.35 million bitcoins available. While that might sound like a lot, from a long-term perspective it is nearing a seven-year low. Since the approval of spot ETFs, reserves have been slowly but steadily dropping. And that is while the aforementioned funds are not yet buying heavily on these exchanges.

We must keep in mind that since the April halving, only around 450 new coins are mined per day. The current daily dollar value of newly mined bitcoins is therefore around USD 40.5 million. Meanwhile, the long-term average daily increase in spot ETFs has been around USD 144.3 million. Coins are thus disappearing from the market much faster than new ones can be mined.

Bitcoin Needs a Catalyst to Break Through USD 100,000

I’ve been looking for some interesting macroeconomic event that could provide the momentum to push us firmly back above the USD 100,000 mark. Trading volumes are currently weak—this level of low volume was last seen before the U.S. presidential election. We’ll see if Donald Trump’s inauguration brings a boost in volumes and market momentum. Until then, the bitcoin price may continue moving sideways between USD 90,000 and USD 100,000.