Bitcoin has not maintained its position around $64,000, leading to a deepening price decline. Initially, it fell to the local support of $62,500 and then to the key level of $60,000. This has been my personal prediction for a short-term move for many weeks.

So, what can we expect now and how should we prepare? Many might feel inclined to panic as we face a continuous decline. I believe this could be a reason for newcomers to exit the market since they haven’t built the patience.

Tip: Explore also our new Mining category

Currently, we need to observe whether the current key support can withstand the selling pressure. If not, the next price target is much lower, and in such a case, I would expect greater panic.

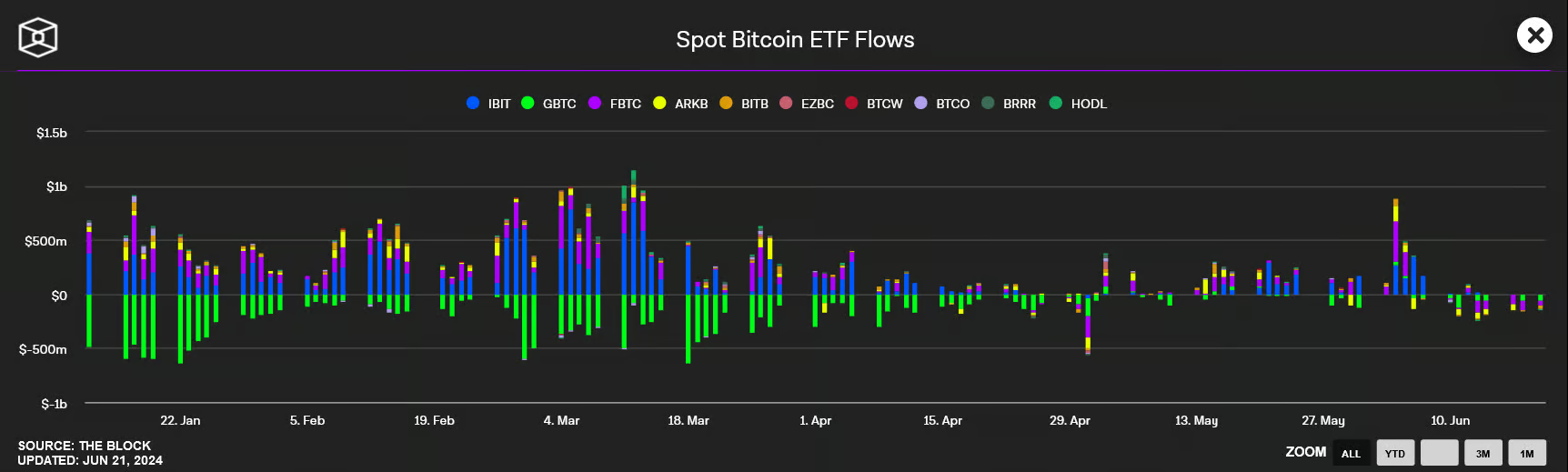

Spot Bitcoin ETFs are Not Trading Much

It turns out that dealing with Bitcoin is not as straightforward as it seems from the interest in spot ETFs. After an initial surge in interest, this segment of the market is completely dead. It looked positive at the beginning of June, but it lasted only a few days. I fear that improvement won’t come anytime soon. I suspect we might see improvement around late summer or early autumn.

Bitcoin’s price has its last chance for a rebound at $60,000

From the perspective of the weekly chart, Bitcoin has finally landed at the price level of $60,000, where the first truly key support is located. Personally, I predicted that we would need to return to this level because there was a complete absence of any significant effort to break through the upper boundary of the sideways box. From this, I concluded that the market needs to gain much more strength at lower prices.

This means that the current decline doesn’t imply anything particularly bad on its own. Of course, watching the price drop is always unpleasant for bulls. However, with this drop, the market gets a chance to re-accumulate at strong support. This gives us a reason to believe that Bitcoin can overcome resistances and reach much higher prices.

I dare to say that we will eventually see a rebound and a significant recovery of price losses. Although it’s impossible to predict if this will be sufficient, we may hold at the current level for a longer time simply because it’s the off-season.

The problem would arise if the resistance is broken and there is at least a daily close below the level. If the weekly candle closes below the support, I would take it as a significant signal for a continued decline. Specifically, the next price level is at $52,000.

Bitcoin’s price on the daily chart is testing key support at $60,000 I would say that a potential drop to $52,000 could trigger panic sales. It’s important to realize that Bitcoin’s price hasn’t been near $50,000 since February. This means that investors and speculators might take such a price drop quite hard and start panicking.

As for the attached daily chart, we can see that the price decline is essentially finalizing. I wouldn’t rule out a fuller test of the support. However, on intraday timeframes, a solid defense can easily be seen.

Conclusion: Price Drops Are Healthy

It’s sensible to understand that price declines are healthy for the market. It’s perfectly fine when the market is cleansed; it’s like taking a breath, allowing it to continue. It’s not always wise to panic, even when Bitcoin’s price breaks through strong supports.

Sure, the situation worsens significantly. However, panic selling has never helped anyone much.

Furthermore, I emphasize again that Bitcoin has made significant gains in a relatively short time, so it was inevitable that profits would be taken. When big players sell, it doesn’t automatically mean the price will fall sharply. They can sell slowly, gradually, so as not to crash the price.