The cryptocurrency markets are experiencing another shock after a massive $2.24 billion liquidation triggered a wave of uncertainty among investors. Recent reports suggest that hidden liquidation volumes could be significantly higher than public data indicates.

The dramatic downturn, caused by the first round of tariff measures imposed by President Donald Trump, surpassed even the liquidations seen during the COVID-19 pandemic and the collapse of the FTX exchange. Key altcoins, including Ethereum and Cardano, lost double-digit percentages of their value within a single hour, deepening concerns across the market. According to industry insiders, elevated leverage in altcoins—particularly Ethereum—has magnified these price swings, with some estimates indicating a threefold increase in liquidation risks compared to Bitcoin.

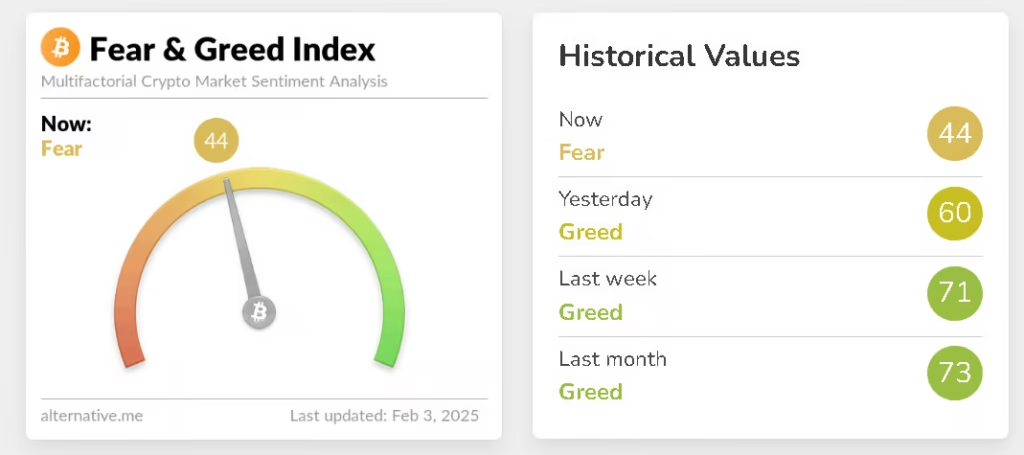

Despite this, some analysts see the situation as a buying opportunity as historically, periods of extreme fear have led to subsequent bull markets. Investors are now closely monitoring developments not only in geopolitics but also in regulatory actions and macroeconomic conditions that could influence the long-term trajectory of cryptocurrencies. For instance, recent data from Glassnode shows that investor fear is at its highest level since the FTX collapse, potentially setting the stage for a robust rebound.

Massive Cryptocurrency Liquidations

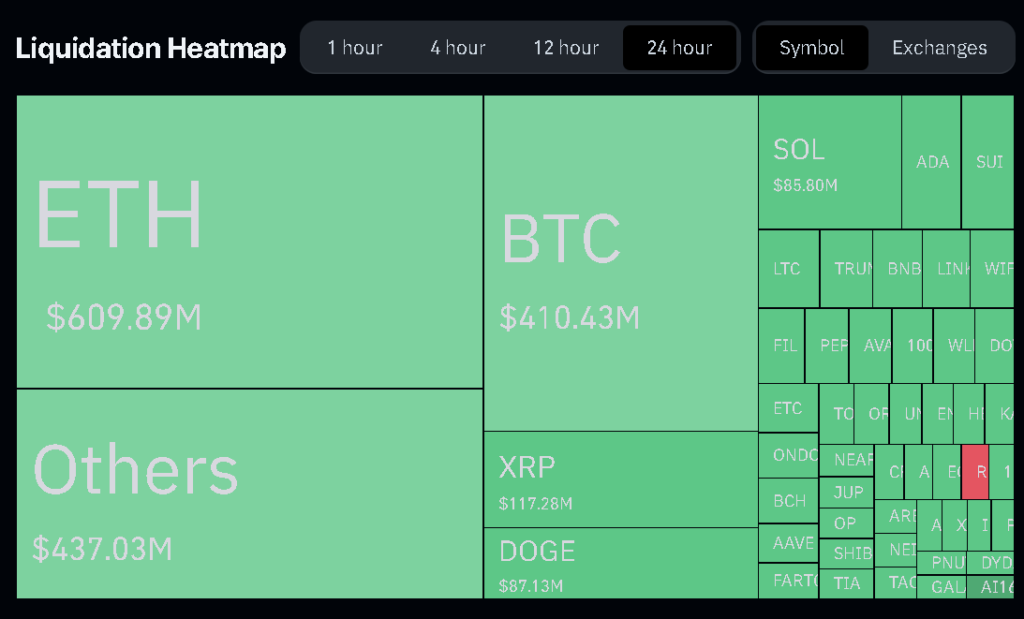

More than $2.24 billion was liquidated from cryptocurrency markets due to rising geopolitical uncertainties stemming from Trump’s tariff policies. Ethereum led the liquidations, with combined long and short positions worth over $609.9 million. Bybit’s CEO Ben Zhou has warned that actual liquidation volumes may be up to five times higher than what standard tracking tools report.

Total daily crypto liquidations on February 3 exceeded $2.24 billion, affecting more than 730,000 traders. The largest single liquidation order was recorded on the Binance crypto exchange for the ETH/BTC trading pair, amounting to $25.6 million, according to data from CoinGlass.

One-Third of Liquidations on Binance

During this period, 36.8% of all liquidations took place on Binance, largely due to its massive user base. Other crypto exchanges involved in the liquidations included OKX, Bybit, Gate.IO, and HTX. Additional filings indicate that leveraged positions in Ethereum have surged by over 300% compared to last year, raising fresh concerns about market overextension.

Long traders lost $1.88 billion, accounting for 84% of all liquidations, reflecting overall expectations of a continued bull market. In January, U.S. spot Bitcoin ETFs attracted nearly $5 billion in investments, setting the stage for a potential $50 billion capital inflow by the end of 2025.

Market Impact

Alongside the massive liquidations, leading altcoins, including ETH and Cardano, saw double-digit losses within an hour. This occurred immediately after U.S. President Donald Trump announced the first round of tariffs on imports from China, Canada, and Mexico. A subsequent market rebound on February 4 followed after the U.S. reached agreements with Mexico and Canada, pushing Bitcoin back to around $100,000. Reuters noted that this swift recovery underscores Bitcoin’s resilience as institutional investors begin repositioning amid geopolitical headwinds.

Joe Consorti, Head of Bitcoin Growth and an analyst at Theya, noted that the $2.24 billion liquidation event triggered by Trump was larger than the liquidations during the COVID-19 pandemic and the FTX collapse.

As of February 3, according to data from Alternative.me, investor sentiment in the cryptocurrency market is classified as “fear.” A comparable index from Glassnode suggests this fear level is the highest observed since the FTX debacle, hinting at a potential market bottom.

Conclusion

The current situation in the cryptocurrency market clearly demonstrates how global political events can shake investor sentiment and trigger massive liquidations.

Although Trump’s tariff measures have led to a sharp drop in prices and heightened investor anxiety, historical patterns suggest that such moments often present strategic buying opportunities for those who believe in the long-term growth of cryptocurrencies. Moving forward, it will be crucial to monitor the next steps of the U.S. administration, inflation trends, and market reactions to Federal Reserve monetary policy. If geopolitical tensions ease and regulatory conditions remain favorable, Bitcoin and other cryptocurrencies could regain upward momentum, reaffirming their position as a high-potential alternative asset class. Analysts at Cointelegraph and other outlets are increasingly optimistic that this downturn may mark the start of a long-term recovery phase, potentially unlocking significant value for patient investors.