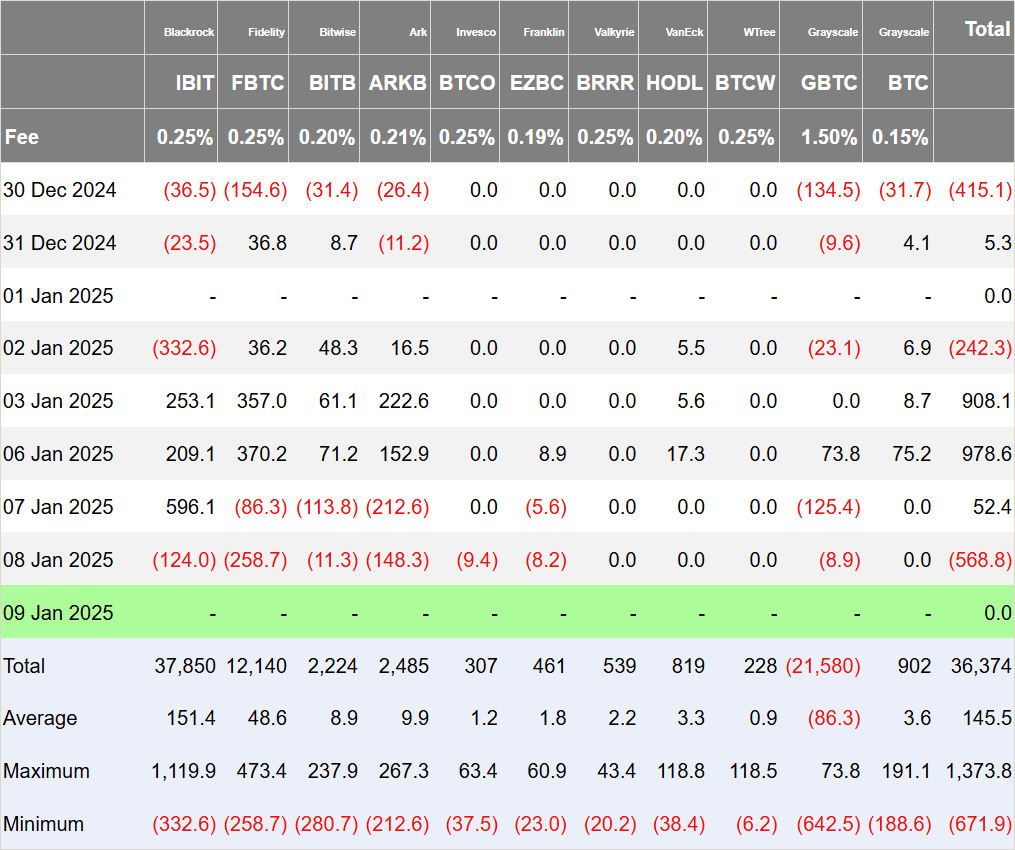

While last Friday and even Monday saw daily growth of nearly one billion dollars in spot Bitcoin exchange-traded funds (ETFs), by Wednesday they had reached record lows on the other side of the spectrum. Not a single one of them recorded growth, and the total daily decline exceeded half a billion USD. It appears that the slump was caused by speculation around the possible sale of a large amount of bitcoins.

The drop of USD 568.8 million is the second-largest single-day outflow since the launch of spot ETFs in January of last year. The current record stands at a daily drop of USD 671.9 million on December 19, the day after the Fed’s latest meeting and Jerome Powell’s hawkish speech. Yesterday, exchanges took a day off to honor the memory of the recently deceased former President Jimmy Carter. The overall weekly change is still in positive territory, though. We will see how the situation develops today.

Market sentiment has cooled sharply

The Fear and Greed Index, which compiles various metrics to gauge market sentiment, has plummeted today. Just yesterday, it was at 69 points—indicating “greed,” and not far from the “extreme greed” threshold (75+). This morning, however, the index for Bitcoin fell to 50 points, which signals neutral sentiment. The market clearly took a hit and is now waiting to see what happens next.

Panic over the sale of seized Silk Road bitcoins spreads

A possible reason behind the outflows from spot ETFs and the drop in Bitcoin’s price may well be reports of a possible sale of bitcoins seized from the Silk Road marketplace. A court approved their sale on December 30, but this news only made it into official media outlets on Wednesday evening. Speculation over a quick sale before Donald Trump takes office probably sparked potential withdrawals. After all, 69,370 BTC, valued at over USD 6.5 billion at current prices, is no small sum. A rapid sale could certainly drive the price down significantly.

Historically, though, we know that after receiving court approval, it can still take officials weeks or even months before they actually sell the bitcoins. Moreover, they have always sold them gradually in order to avoid depressing the price and to maximize profits. A rushed sale is therefore unlikely, and there is also the possibility that the newly elected U.S. president could revoke permission for the sale. At the very least, halting such sales before the election was one of his promises.

Thanks to Arkham Intelligence, you can check at any time whether the seized bitcoins are still in the U.S. government’s possession or have already been moved to an exchange or the wallet of a new owner.

We will see whether the market panic that occurred during the exchange holiday has subsided and whether Bitcoin’s price will return to growth. So far, that appears to be the case.